I love putting all my daily spends on credit cards to get reward points and cashback, however, the most boring part is to make credit card bill payments, simply because there are no cash backs or reward points for it. However, this has now changed, with the launch of Cred app, one can get rewarded for making credit card payments. The app is founded by Kunal Shah, the founder of Freecharge which was eventually sold to Axis Bank.

Well, the basic model of Freecharge, Cred or any other app remains the same, you use the app, do some transaction and get rewarded for it.

In this post, I will provide my take on Cred app, its pros and cons and ways to maximise returns, along the way will also give my take on what features of Cred one should use and the ones one should avoid.

So, How to enroll in Cred?

Well, Cred markets itself as member's only app and when you create your account, it asks for your phone number and looks up the credit bureaus (Experian and CRIF) for your credit score.

The first thing that comes to mind, why Cred needs my credit score? It’s their business model or the story they have sold to PE/VC firms that we will only enrol individuals with a certain credit score on their platform. So they like to enroll only individuals above a certain threshold, but no one knows what the cut-off is.

How Cred app works?

Once you register a credit card(s) with the app, one can only make credit card payments through it. So say, the credit card bill was 25000 and once the payment is done via Cred, one receives 25000 Cred point aka coins.

How long it takes for payment to reflect on my statement?

Typically, the payment reflects in one’s credit card account on the same day or the next. So to be on the safe side, make the payment 1-2 working days before the due date.

Where to use the Coins?

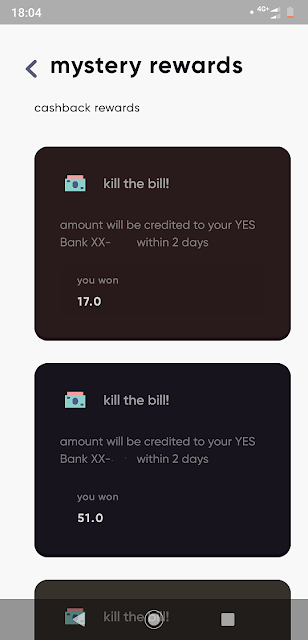

The coins then can be used in the app to redeem against the reward catalogue present in the app. The redemption value of point is dynamic and depends on the kind of rewards one chooses, as per my experience if one uses “Kill the Bill” (digital scratch card concept) i.e. cashback against coins option the reward rate is paltry ~0.3%, and even the number of times this can be used is limited.

|

| Kill the Bill option gives low reward rates |

Deeper analysis on my history of “Kill the Bill” reveals that reward rate on burning 1000 coins is highest (@ ~1%) than that for any other denominations. On higher denominations, such as burning 15000 coins has given me a reward rate of 0.17% (baring 2 outlier instances, which improved reward rate to 0.3%). So, it makes sense to burn 1000 coins in Kill the Bill and save the rest for other offers/vouchers.

Another trend that I have noticed is the reward rate on “Kill the Bill” is trending downwards, clearly an impact of more users coming on the platform and burning coins for cashback.

Another option is to skim through rewards catalogue and choose a reward, as per my experience, the reward rate here is much better at ~3.25%. Rewards are dynamic and they keep on changing regularly. So the app has done a good thing here to make sure you keep coming back multiple times every month and not just once to pay your bills.

|

| Some exciting offers currently on Cred |

Also, occasionally Cred offers fabulous offers where reward rate very high, example currently they are offering Sunburn Wiz Khalifa ticket for 75000 coins, on BookMyShow the price is 4000/ticket. Thus the reward rate is 5%. In the past, they have had similar offers on Sunburn events.

What are the other features in the app?

Cred also offers something known as “Cred Protect”, where it offers features such as due date reminders, hidden charges alert, smart statements, WhatsApp notifications etc.

|

| Cred Protect - Needs access to too much financial data |

These sound like awesome add-ons to have, but the downside is this feature needs too many permissions such as access to one’s email-id to scan credit card statements, bank account statements to understand one’s spending pattern etc.

This is the feature I don’t use in the app and don’t even plan to explore because the kind of data access it needs is scary (access to one’s email, rights to scan through email, access to one’s credit card statements, and access to one’s bank account statements). Also, with the plan of the founder on how to scale up and monetize Cred, makes it a bit scarier (Gist of the video interview- they plan to offer personal loans on Cred depending on your spending and saving patterns). See the video here

Further, banks either which ways send enough SMSes or app notification to remind one of the due dates that there is no need for another app to give a reminder on the same thing.

Summary

Cred is a cool app, which enhances the reward rates on credit cards by ~3% at present. As per the data, this will likely trend downwards in the times to come. Still, as long as it adds up credit card reward, one can continue using it.

However, I am going to completely stay away from Cred Protect feature in the app, as the kind of data access it gets on my financial spending pattern is scary and I am not willing to share it. Maybe a bit too much intrusion into one’s financial data.

Pros:

- Nice layout, intuitive design

- Reward rate on the catalogue is 3%, could be even higher for others if used smartly.

- Reward catalogue gets refreshed often with new offers/vouchers

- One gets to see the credit score from 2 credit bureau (Experian and Crif)

Cons:

- Reward rate on Kill the Bill is paltry 0.3% (Higher for burning 1000 coins, but very low on other higher denominations)

- Reward rate is steadily declining

- Cred Protect feature although good gets access to one’s sensitive financial data

- Shows only the credit score, the detailed credit report is not available

So, go ahead and download the Cred app and enjoy more rewards by paying credit card bills. You can download the Cred app from here: Download Cred

Do let me know your experience of using the app and your views on the same.

No comments:

Post a Comment